Photo: TDM

Economists have expressed their concern over the government’s traditional budget outlay prepared for the FY 2023-24 to be placed on June 1 as they think the extra-large budget would not address the country’s pressing problems like inflation and reserve crunch.

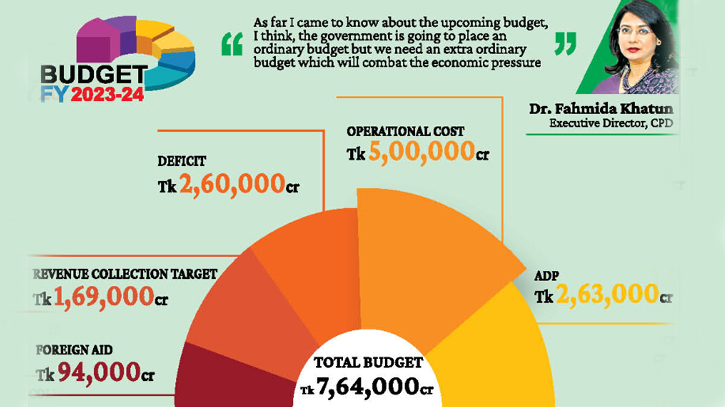

According to Finance Ministry, the next fiscal year’s budget is likely to be as high as Tk 7,64,000 crore with a deficit of Tk 2,60,000 crore, which is 10.6 per cent higher than that of the current fiscal year’s budget.

Economists think that the upcoming budget will be a regular budget which will not address the ongoing economic crisis like inflation, government’s loan from the central banks, monetary policy in collecting revenue, and interest rates policy.

“As far as I came to know about the upcoming budget, I think, the government is going to place an ordinary budget but we need an extra ordinary budget which will combat the economic pressure and reserve crunch,” Fahmida Khatun, Executive Director, Centre for Policy Dialogue (CPD) told The Daily Messenger.

She added, “We have experienced ordinary budget even in Covid-19 crisis. The government has borrowed Tk 1,06,000 crore of money from the central bank which was printed taka that has fueled the inflation.”

The government has targeted to borrow Tk 1,36,000 crore in next fiscal year which will increase inflation substantially. So, policy should be taken considering the economic pressure points, said the CPD chief.

Fahmida recommended the government to increase the social safety net so that the poor can survive during the economic crisis.

According to the Finance Division, the Prime Minister has given instructions to formulate a suitable budget to ensure economic stability by avoiding unnecessary expenditure. Therefore, even though it is an election year, there is no public satisfaction expenditure in the next budget.

Ahead of the election, the proposals that have been given to the Prime Minister from various ministries, keeping in view the macroeconomic stability, she has rejected almost all the proposals. Although this is the last budget of the government before the election, it is said that the new budget will not be compatible with the budget of other election years.

According to the finance department’s estimate, the budget of Tk 7,64,000 crore will have an allocation of Tk 2,63,000 crore for the annual development programme.

Of the total development expenditure, the allocation from domestic sources will be Tk 1,69,000 crore and the expenditure from foreign aid will be Tk 94,000 crore. The remaining Tk 5,00,000 crore of the budget will be spent on the administrative sector which is Tk 4,31,000 crore in the current budget.

Operating expenditure includes Tk 77,000 crore for salaries and allowances of government employees, Tk 40,000 crore for purchase of goods and services, Tk 1,10,000 crore for loan interest payments, Tk 1,18,000 crore for social safety net and Tk 1,05,000 crore for subsidies and incentives, the Finance Department proposed.

The International Monetary Fund’s timebound conditions for the $4.7 billion loan, the ever rising inflation and the upcoming polls are weighing heavy on the finance ministry’s mind as it does its computations for the forthcoming budget.

“The budget will be extremely challenging,” said Ahsan H Mansur, Executive Director of the Policy Research Institute of Bangladesh (PRI).

For funding, the government has become central bank-dependent, which is not right as it is inflationary, he added.

He suggested the government to come out of this practice as inflation will get worse otherwise.

In the first 10 months of the ongoing fiscal year, inflation hovered around 9.20 per cent, way above the budgetary target of 5.6 per cent, according to data from the Bangladesh Bureau of Statistics (BBS).

The proposed budget for the FY 2023-24 should not lack measures to address the rising inflation, according to South Asian Network on Economic Modeling (SANEM).

“The government can have waived taxes on import of essentials as a temporary measure to contain inflation,” said Selim Raihan, Executive Director of SANEM.

Selim also recommended strengthening the market monitoring mechanism so that unscrupulous businesses could not take advantage of the situation.

In this regard, AB Mirza Azizul Islam, former adviser to a caretaker government, told TDM that the size of the budget is increasing every year. Also, the amount of deficit is increasing by leaps and bounds. The size of the budget may increase considering inflation and GDP size. However, not the budget size but the implementation rate matters.

Pointing out that the upcoming budget should not be election-oriented and public-satisfying, he said that the main challenge of the upcoming budget will be to keep inflation under control.

He also reminded the authorities to keep in mind the pressure that has been created in the domestic economy due to the decrease in the reserves of the central bank.

TDM/SD