Photo: TDM

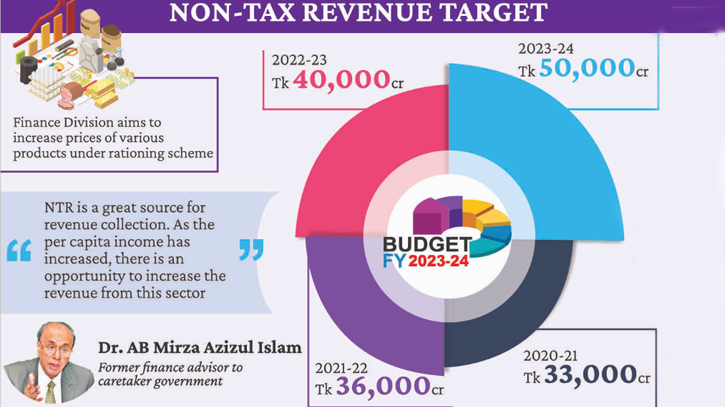

The government is paying special attention to collect non-tax revenue (NTR) in the budget for the next financial year 2023-24. A target of collecting Tk 50,000 crore has been set from this sector, according to the Ministry of Finance. The government has set a target to collect Tk 5,00,000 crore from revenue sectors in the next financial year.

Of this, the National Board of Revenue (NBR) will collect Tk 4,30,000 crore from three sectors – income tax, value added tax (VAT) and customs duties. Of the remaining Tk 70,000 crore, Tk 50,000 crore will be collected from Non-Tax Revenue (NTR). The government expects to get another Tk 20,000 crore from non-NBR taxes and grants.

In the main budget for the current fiscal year 2022-23, the government had set a target of collecting Tk 45,000 crore from NTR which was reduced to Tk 40,000 crore in the revised budget. It has been again increased to Tk 50,000 crore in the proposed budget for the next financial year.

According to the finance division, plans have been taken to increase the prices of various products under ration in the next financial year 2023-24 including subsidies provided to various government agencies. The government is now working on increasing the fees which have not been increased for 5 to 15 years.

As a result, land registration fees in the new financial year, rental price of bazaar, entrance fee to zoo, prices of 50 types of products including rice, pulses, ghee, clothes given in ration to some agencies may increase. Some of these charges will be levied from July 1, while others will be subjected to the terms of a notification issued after the budget.

Welcoming this initiative to collect government funds, Mustafizur Rahman, Distinguished Fellow of Center for Policy Dialogue (CPD), told The Daily Messenger that there is an opportunity to update the rate at which NTR is collected in many cases. However, it should be kept in mind so that it does not create extra pressure on the people. Arrangements should be made to reduce the suffering of the people while paying fees or charges simultaneously, he added.

Earlier, the NTR collection target in 2020-21 was set at Tk 33,000 crore. But Tk 58,862 crore was collected in that financial year. Some companies kept their earnings as fixed deposits (FDRs) in various banks for long periods as non-jurisdictional. As they returned them under the pressure of the finance division, the collection was more than the target in that financial year, said a finance ministry official.

It is known that the finance division has been working on NTR for several years. Although it has come under some discipline, there is still a lot of work to be done. The aim of the finance division is to bring it fully under control by the next financial year.

Former finance advisor to a caretaker government AB Mirza Azizul Islam, told TDM, “NTR is a great source for revenue collection. As the per capita income has increased, there is an opportunity to increase the revenue from this sector by increasing the tax in various areas.”

For this purpose, a few months ago, Bangladesh Standard and Testing Institute (BSTI), Bangladesh Sugar and Food Industry Corporation (BSFIC), Office of the Chief Import-Export Controller, Directorate of Shipping, Directorate of Environment, Registrar of Joint Stock Companies and Firms were noticed by the finance division. Letters have been sent to various directorates and inspectorates to prepare for the increase in fees.

Apart from this, the finance division has also written to the ministries related to various levies including Ministry of Lands, Ministry of Livestock, Ministry of Railways, Ministry of Civil Aviation and Tourism, Ministry of Water Resources on the same issue. Ministries and departments have raised some fees before the budget, while others are in the process of raising them.

TDM/SD