Photo: Collected

Economists have criticised the idea of Foreign Minister Dr AK Abdul Momen as he proposed recently to make the tax return submission mandatory for those who have National Identity Card (NID).

While talking to The Daily Messenger (TDM), former lead economist of World Bank Dhaka, Zahid Hussain said it is an unrealistic proposition as NID is a universal thing, which is issued for all the citizens of a country, including a beggar and student.

“There are 90 lakh TIN holders in the country, all of whom are not tax payers. Only one third of the TIN holders pay tax which the authorities concerned should scrutinize to increase the revenue which is the ultimate goal,” he said.

Terming the proposition of the foreign minister as ‘putting the cart before the horse’, the noted economist said that the authorities should find out who have taxable income among the TIN holders and ensure they submit tax return. There are many scopes for reform to increase tax net which should be given priority, he added.

Echoing Zahid Hussain, South Asian Network on Economic Modeling (SANEM) Executive Director Dr Selim Raihan told TDM that the proposition of the foreign minister may be considered as a wishful thinking and not a practical one.

“There is a threshold for taxable income and it is not possible to identify any person who have taxable income with a mere NID number. Then comes the question of assessment and the responsible authorities to assess all the NID holders,” said Selim Raihan.

He criticised that out of the total 3 crore people who are capable to pay tax, around 30 lakh pay tax. But the authorities do not have attention to bring them under tax net to increase revenue without creating pressure on the existing tax payers.

It is easy to say many things but difficult to implement as priority should be there to attain the objective of increasing revenue, Selim Raihan added.

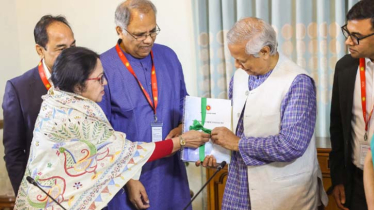

The foreign minister was addressing a memorial programme organized by Economic Reporters Forum (ERF) on Saturday to remember life and works of former Finance Minister AMA Muhith.

“During Muhith bhai's tenure, I proposed him to make return filing mandatory for all national identity card holders to increase the tax coverage," the foreign minister said.

"But till date that has not been implemented due to bureaucratic tangles," he said adding if all NID card holders can be brought under tax net, the tax-GDP ratio which is now 7 to 8 per cent will increase to 20 to 25 percent.

The ERF organised the memorial meeting to discuss late Muhith's life and works.

TDM/SD