Photo : Messenger

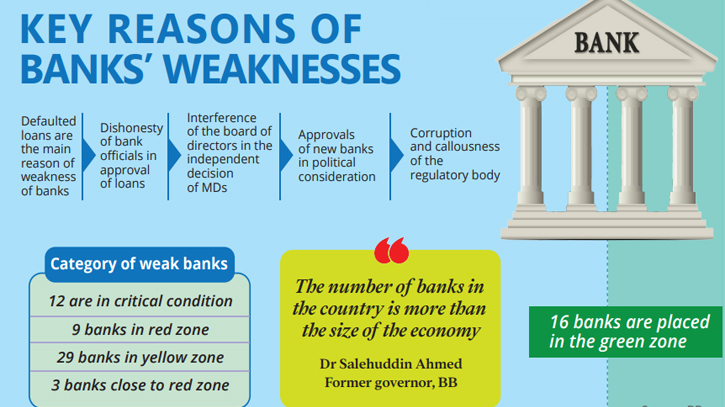

Over the past few years, the country's banking sector, a key driver of the economy, has been experiencing ominous signs of deterioration. This pivotal sector has been steadily weakening due to pervasive irregularities and corruption. Bankers and economists point to five primary reasons behind the sinking state of the country's banking industry.

They said that in the meantime, many banks are about to close due to the crisis. That's why the central bank identifies weak banks and puts them on the path of a merger. However, it would be difficult to maintain life support like this for a long time. According to them, Bangladesh Bank should take strict action against the defaulters by going beyond political considerations.

AB Mirza Azizul Islam, former caretaker government's finance adviser, told The Daily Messenger, “The collapse of the banking sector is due to defaulted loans, dishonesty of bank officials, interference of the board of directors in the independent decision-making of the managing directors (MDs), more bank approvals than necessary due to political affiliation or political consideration of the bank owners, and corruption of the regulatory body Bangladesh Bank's officials.”

Bangladesh Bank has recently identified 38 banks, including six state-owned banks, as weak banks after analyzing the condition of 54 banks in the country. The central bank has categorized the banks at a time when a merger of 10 banks is being considered early next year.

According to a confidential report of Bangladesh Bank, more than two-thirds of the country's banks are now weak. Banks in the 'Red zone' are the worst (poor), and banks in the 'Yellow zone' are weak, while 'Green zone' banks are of good quality.

Of the 54 banks, 12 are in critical condition, nine of which have already moved into the red zone. There are 29 banks in the yellow zone; of these, three banks are located very close to the red zone. On the other hand, only 16 banks are placed in the green zone. Of these, eight are foreign banks. That is, the number of domestic banks in the green zone is only eight.

However, Bangladesh Bank's Executive Director and Spokesperson Md Mezbaul Haque said that Bangladesh Bank has not made any list of weak or strong banks. A list has been made for guidance regarding the state of the country's banking sector in line with the global market and what changes the banks can bring from their position in this sector.

But several senior officials of Bangladesh Bank told The Daily Messenger on condition of anonymity that a list has been published. However, that is for the benefit of the internal workings of the central bank, not for the general public. In this list, 16 banks are in a good position in the country. Out of these, eight are foreign banks, and eight are domestic banks.

A managing director of a private bank, who did not wish to be named, told The Daily Messenger, “It goes without saying that the country's banking sector is not in a good condition. Most of the banks are doing wrong by any means. The bank officials and owners are responsible for this predicament, as well as the regulatory body cannot escape responsibility.”

Dr. Salehuddin Ahmed, former governor of Bangladesh Bank, told The Daily Messenger, “The number of banks in the country is more than the size of the economy. And those that have been given licenses, most of them have been taken for political considerations or by someone close to power. As a result, politics has done more harm than good in this case. Because of their various irregularities, the banks are now weakened.”

He also said, “If the banks were run efficiently and well, no question would have arisen. Rather, they have been given various concessions at different times without monitoring them on time. If measures had been taken then, this list would not have been so long. As a result, the responsibility for this rests with the central bank.”

Meanwhile, the central bank has already planned to merge 10 weak banks with other strong banks. Last week, in the meeting of bank owners with Bangladesh Bank, there was a detailed discussion on the merger of weak banks. In that meeting, Bangladesh Bank Governor Abdur Rouf Talukder said that 10 banks of the country will be merged by January 2025. In this case, the weaker banks themselves have the opportunity to coordinate with the bank they want to merge with.

In this regard, Dr. Zahid Hussain, the former chief economist of the World Bank Dhaka office, told The Daily Messenger, “Non-performing loans are at the root of the collapse of the banking sector. In many cases, bank owners, along with businessmen who are close to bank owners, have defaulted on huge loans anonymously. The corrupt officials of the central bank have seen but ignored them. As a result, today this sector is in dire straits.”

Messenger/Fameema