Photo : Messenger

The global coronavirus pandemic and the Russia-Ukraine war have impacted the global economy, affecting Bangladesh as well. The country's economy is still recovering from this crisis, with a revenue collection shortfall of over Tk 18,000 crore during the first eight months of the current fiscal year. Additionally, the implementation of the budget is progressing at a slower pace.

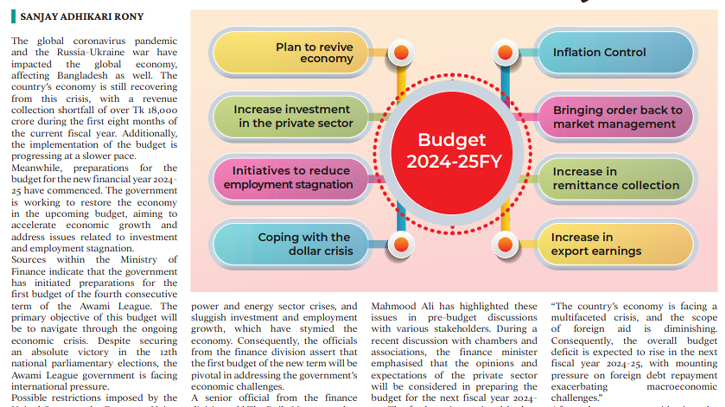

Meanwhile, preparations for the budget for the new financial year 2024-25 have commenced. The government is working to restore the economy in the upcoming budget, aiming to accelerate economic growth and address issues related to investment and employment stagnation.

Sources within the Ministry of Finance indicate that the government has initiated preparations for the first budget of the fourth consecutive term of the Awami League. The primary objective of this budget will be to navigate through the ongoing economic crisis. Despite securing an absolute victory in the 12th national parliamentary elections, the Awami League government is facing international pressure.

Possible restrictions imposed by the United States or the European Union on the ready-made garment sector could potentially shock Bangladesh's global trade. The country is already grappling with high foreign debt, a dollar crisis, negative balance of payments, declining revenue collection, inflation, market instability, power and energy sector crises, and sluggish investment and employment growth, which have stymied the economy. Consequently, the officials from the finance division assert that the first budget of the new term will be pivotal in addressing the government's economic challenges.

A senior official from the finance division told The Daily Messenger that the government is actively engaging in discussions with the private sector to tackle these issues. As a result, there is an expectation of a positive momentum returning to the country's economy in the coming year.

Finance Minister Abul Hassan Mahmood Ali has highlighted these issues in pre-budget discussions with various stakeholders. During a recent discussion with chambers and associations, the finance minister emphasised that the opinions and expectations of the private sector will be considered in preparing the budget for the next fiscal year 2024-25. The forthcoming national budget aims to support the private sector by introducing projects and effective initiatives to stimulate employment and investment.

Dr Zahid Hussain, former chief economist of the World Bank's Dhaka office, told The Daily Messenger, “The country's economy is facing a multifaceted crisis, and the scope of foreign aid is diminishing. Consequently, the overall budget deficit is expected to rise in the next fiscal year 2024-25, with mounting pressure on foreign debt repayment exacerbating macroeconomic challenges."

After the corona epidemic, the country’s economy is again in crisis due to the global recession. The shock of the economy creates the biggest crisis in the country’s foreign exchange management. The price of the dollar started increasing, and the dollar crisis was created. On the other hand, the cost of imports continued to increase, which Bangladesh is still suffering from.

However, that acute crisis is now on the wane. The dollar has also become somewhat flexible in recent times. Expatriates are sending huge amounts of remittances ahead of the current Ramadan and Eid-ul-Fitr. On the other hand, export earnings have also started to increase.

According to the data from Bangladesh Bank, in the first 22 days of this month, remittances worth $141.44 crore have come through the banking channel. If this trend of remittance flow continues, it may cross $2 billion this month. Apart from this, Eid-ul-Azha is two months after Eid-ul-Fitr, which is the biggest religious festival for the people of Bangladesh. As a result, the remittance flow is expected to increase further in the rest of the fiscal year.

However, the government is somewhat worried about the increase in foreign debt repayment pressure, which will increase further in the coming financial year. As a result, it is known that some effective measures will be taken to ease debt repayment in the next budget.

In the first eight months of the current financial year (2023-24), the government has repaid $203 crore in foreign debt, including interest and principal. Out of this interest is $80.59 crore and principal is $122.40 crore. However, during the same period last year, Bangladesh paid off foreign debt of $142.41 crore. In other words, the amount of foreign debt repayment increased by $61 crore dollars in 8 months within a year.

Economists believe that the debt repayment pressure will increase in the next year, which the government will have to take a suitable plan in foreign exchange management and at the same time increase the income of foreign exchange.

AB Mirza Azizul Islam, the former caretaker government’s finance advisor, told The Daily Messenger, “In the current context, it is very important to formulate an implementable budget. Instead of giving an unnecessary imaginary budget, steps should be taken considering the economic situation. Meanwhile, the government has taken a lot of foreign loans for several large projects in the country. The pressure to repay them will increase from year to year. In that case, the foreign loans and aid that would have been available to cover the budget deficit may decrease somewhat.”

“Increasing investment in the private sector and creating employment will be a big challenge to deal with the reserve crisis. Apart from this, a delegation of the International Monetary Fund (IMF) will come to Dhaka to review the country’s macroeconomics and discuss the third tranche of debt. This will have an impact on the new budget,” he added.

After assuming power for the fourth consecutive term, the Awami League government has taken some effective steps to deal with the economic crisis. To implement them, increasing revenue, reducing government expenditure, controlling inflation, establishing good governance of the country's financial sector, establishing alternative industries to imports and other developmental activities will be given special importance in the new budget. These steps will play an important role in our overall economic development along with the expansion of the private sector.

Messenger/Fameema