Photo: Messenger

The Ministry of Power, Energy and Mineral Resources is experiencing a fund crisis. As a result, it cannot import adequate amounts of liquefied natural gas (LNG), coal, and fuel oil to feed the power plants. It even failed to pay the huge outstanding bills to the private partners.

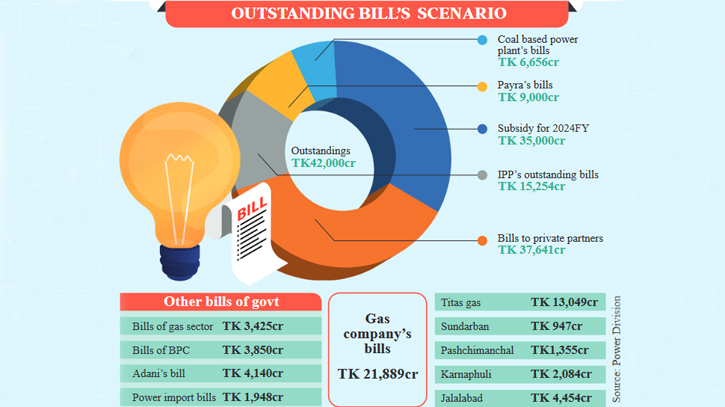

The outstanding bills in the power and energy sector are Tk 42,000 crore. Of that, Tk 37,641 crore is owed to the power producers and Tk 3,425 crore in the energy sector.

Experts think due to the fund crisis, the sector will face a disaster, such as the closure of small and medium power plants. This will increase countrywide load-shedding.

Prof M Tamim, a prominent energy expert and ex-adviser to the caretaker government, told The Daily Messenger, “If the situation goes on like this, the sector will face a disaster even though the government is trying to collect money by selling bonds.”

He said the small and medium power producers who have only two or three plants will not survive. “The government should pay the outstanding bills soon. Otherwise, small plants will shut down.”

The outstanding bills of rental and independent power producers stand at Tk 15,254 crore, coal-based power plants Tk 6,656 crore, Adani Tk 4,140 crore, power import from India Tk 1,948 crore, and Payra Tk 9,000 crore.

On the other hand, outstanding bills of gas distribution companies amount to Tk 21,889 crore. Of this, Titas’ bills are Tk 13,049 crore, Sundarban’s Tk 947 crore, Paschimanchal’s Tk 1,355 crore, Karnaphuli’s Tk 2,084 crore, and Jalalabad’s Tk 4,454 crore.

The Finance Division has started converting electricity arrears into subsidy bonds to avoid bill payment liabilities. Till January this year, the division sold bonds of Tk 10,599 crore to public and private banks against subsidies and outstanding loans.

State Minister for Power, Energy and Mineral Resources Nasrul Hamid told The Daily Messenger, “We have some problems in paying the dues. But some arrears are being paid. The rest will be resolved through discussions with the Finance Division.”

He said that the government has arranged the dues of the private power plants through bonds and dollars will be needed to repay foreign debts.

Policy Research Institute (PRI) Executive Director Dr Ahsan H Mansur told the Daily Messenger the electricity import contracts with foreign companies should have been made more carefully. “If we pay more for electricity per unit, we will need more dollars if we want to pay in dollars.”

He also said that banks are not able to take on the government's power sector loan liabilities. The government needs a long-term plan for clearing the unpaid electricity bills, he added.

In the financial year 2023-24, Tk 35,000 crore was estimated for subsidy support. Meanwhile, the Power Division sought Tk 4,500 crore subsidies for April, Tk 4,500 crore for May, and Tk 4,701 crore for June.

Bangladesh Oil, Gas and Mineral Corporation (Petrobangla) has outstanding bills of about Tk 5,000 crore. This includes the bills owed to LNG supply companies. Apart from this, many bills owed to international oil and gas extraction companies (IOCs) that extract and supply domestic gas have also become due.

On the other hand, the arrears of the oil-supplying companies to the Bangladesh Petroleum Corporation (BPC) are about Tk 3,850 crore.

From the start of the summer season in March, additional fuel will be needed to run the power plants. The imports of gas, coal, and fuel oil should be increased. But considering the lack of funds and the dollar crisis, doubts have arisen about whether enough fuel can be imported for power plants.

The country is already experiencing load-shedding because the government cannot import the required fuel for the power plants that are sitting idle. About 60 per cent of the generation capacity is sitting idle due to the scarcity of fuel.

The current installed capacity of the country is 31,000MW while generation is 15,000MW. Moreover, due to lack of electricity, industries cannot run in full swing and production has dropped as a result.

Messenger/Disha