Photo: Messenger

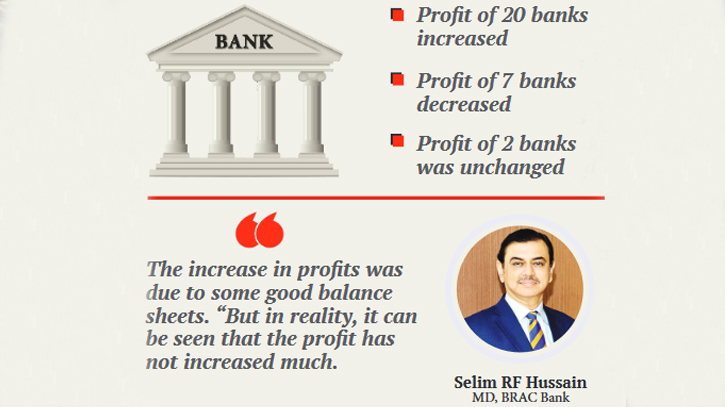

Last year was quite challenging for the banking sector. Despite that, the profits of most of the listed banks increased.

After reviewing the audited financial reports of the banks from January 1, 2023 to December 31, it was found that the profit of 20 banks out of 29 increased compared to 2022. Banks also increased the amount of dividends paid to shareholders as profits rose.

On the other hand, the profits of two banks remained unchanged during this period. And the profits of seven banks decreased.

Economists and bankers say that the profits shown by banks are only on paper. The real situation is that banks are not in a good condition as most of them have liquidity crisis and there is a lack of good governance. As a result, banks have become burdened with default loans.

Managing Director and CEO of BRAC Bank Selim RF Hussain told The Daily Messenger that the increase in profits was due to some good balance sheets. “But in reality, it can be seen that the profit has not increased much. You can notice the condition of good governance and liquidity of banks.”

In addition, against the increase in the value of the dollar, taka has depreciated by more than 30 per cent, said the president of the Association of Bankers Bangladesh (ABB).

Golam Awlia, managing director of NRBC Bank, told The Daily Messenger, "We have increased quality loan disbursement. Small loans are given more than large ones. That's why the recovery is good. Due to these reasons, our profit has been good.”

Mohammed Farashuddin, former governor of the Bangladesh Bank, said that there is a lack of good governance in banks. “Due to repeated rescheduling of loans, there has been a liquidity crunch in the banking sector. To eliminate this crisis, the central bank is printing money in various ways and that's why inflation is not decreasing.”

He said irregularities are happening in banks, but the Bangladesh Bank is not taking any action. He also commented that it is important to bring good governance back in the banking sector for the sake of the economy.

Dutch-Bangla Bank almost doubled its profit for the year ending on December 31, 2023. As a result, its earnings per share (EPS) stood at Tk 10.72, which was Tk 7.57 in the same period of the previous year. 35 per cent dividend will be paid to the shareholders. It paid 17.5 per cent dividend in the previous year.

NRBC Bank’s EPS rose by Tk 0.7 to Tk 2.40. In the previous year, it was Tk 2.33. The bank has decided to declare 11 per cent dividend to the shareholders. The previous year, it paid a dividend of 5.50 per cent.

The bank also gave more dividends to the shareholders as profit increased.

Southeast Bank’s EPS increased by Tk 0.30 to Tk 1.66. The previous year's earnings per share was Tk 1.36. The bank has decided to pay 10 per cent dividend to the shareholders. It paid 6 per cent dividend in the previous year.

EPS of Premier Bank increased by Tk 0.19 to Tk 3.37. It will pay 12.50 per cent dividend to shareholders. It paid the same dividend in the previous year as well.

United Commercial Bank’s EPS was Tk 1.52. In the previous year, the EPS was Tk 2.29. 10 per cent dividend will be given to the shareholders. In the previous year, it paid 5 per cent cash dividend to shareholders.

Jamuna Bank’s EPS was Tk 2.91, which was Tk 1.95 in the same period of 2022. It has decided to pay 26 per cent dividend to shareholders. It paid 17.50 per cent dividend in 2022.

Social Islami Bank’s EPS stood at Tk 1.96, which was Tk 1.90 in the previous year. 10 per cent dividend will be paid to the shareholders. In the previous year, the dividend was 5 per cent.

Uttara Bank’s EPS stood at Tk 4.32, which was Tk 3.69 in the previous year. It has decided to pay 30 per cent dividend to shareholders. It paid a dividend of 14 per cent in the previous year.

BRAC Bank’s EPS stood at Tk 4.73 in 2023, which was Tk 3.75 in the year before. The bank will pay 20 per cent dividend to the shareholders. It paid a dividend of 7.50 per cent in the previous year.

Standard Bank’s EPS increased by Tk 0.24 to Tk 1.27, which was Tk 1.03 in the previous year. The bank has decided to pay 5 per cent dividend to the shareholders. It paid a dividend of 2.50 per cent in the previous year.

Trust Bank's EPS rose by Tk 1.56 to Tk 4.97. It has decided to pay 20 per cent dividend to shareholders. In the previous year, it paid 10 per cent dividend to shareholders.

NRB Bank’s EPS stood at Tk 1.35. It has decided to pay 10 per cent cash dividend to the shareholders. In 2022, the EPS was Tk 0.94. It did not pay any dividend to shareholders that year.

Midland Bank’s EPS was Tk 1.77. The previous year's EPS was Tk 0.88. Union Bank’s EPS was Tk 1.58, which was Tk 1.57 in 2022.

Mutual Trust Bank’s EPS increased by Tk 0.50 to Tk 2.91. Its EPS in the previous year was Tk 2.41. The EPS of First Security Islami Bank stood at Tk 2.85. In 2022, it was Tk 2.56.

The EPS of Global Islami Bank stood at Tk 1.30. In the previous year, it was Tk 0.98.

The EPS of Al-Arafah Islami Bank stood at Tk 2.14. In the previous year, it was Tk 1.89. Prime Bank EPS stood at Tk 4.24, which was Tk 3.53 in the previous year. The bank will pay 17.50 per cent dividend to shareholders.

Islami Bank’s EPS stood at Tk 3.95, which was Tk 3.83 in the previous year.

Profits were unchanged for Dhaka Bank and Shahjalal Islami Bank. Last year, EPS of Dhaka Bank was Tk 1.66 and that of Shahjalal Islami Bank was Tk 3.22.

On the other hand, the profit of seven banks decreased. Among them, Bank Asia’s earnings per share decreased by Tk 0.83 to Tk 1.79, which was Tk 2.62 in the previous year. South Bangla Agriculture Bank’s EPS stood at Tk 0.66. In the previous year, it was Tk 0.72.

Mercantile Bank’s EPS stood at Tk 1.86, which was Tk 2.12 in the previous year.

NCC Bank’s EPS was Tk 2.7, which was Tk 2.38 in the previous year. One Bank’s EPS stood at Tk 1.33, which was Tk 1.51 in the previous year.

IFIC Bank’s EPS stood at Tk 1.64, which was Tk 1.88 in the previous year. ICB Islamic Bank’s losses rose. Its loss per share stood at Tk 0.85, which was Tk 0.38 in the previous year.

Messenger/Disha