Photo : TDM

Despite the multifaceted activities of Bangladesh Bank (BB), the reserves of the central bank are not increasing. On the contrary, the reserves fell further during the past week. As a result, the dollar price in the open market has once again created a turbulent situation, intensifying the dollar crisis in banks as well.

According to data from the central bank, the country currently holds $23.14 billion, which is equivalent to 2,311.40 crore dollars in reserves as calculated by the IMF. This marks a decrease from the $23.26 billion, or slightly over 2,326 crore dollars, reported just a week ago. Consequently, the reserves have declined by $15 crore within a single week.

IMF calculations suggest that the current reserves in the country can cover approximately 4 months' worth of import expenses. On July 13, the central bank for the first time disclosed the reserve amount according to the IMF’s calculations, which stood at 23.57 billion dollars. Previously, in June, according to the IMF’s BPM-6 formula, the country's reserves were reported at 24.75 billion dollars. This indicates a decrease in the country's reserves over the past three months.

On the other hand, the value of money is decreasing day by day, leading to an increase in the price of the dollar. Although the central bank and the government have initiated various measures to alleviate the dollar crisis, it remains unresolved. BB continues to sell dollars from its reserves in the new financial year, following the same practice from the previous year, in an attempt to 'stabilize' the market. Despite these efforts, the currency has depreciated by up to 30 per cent within just a few months.

Experts express concern that the situation could worsen, as they see no indication that the dollar situation will improve soon. This is due to a lack of timely and appropriate decisions by the central bank. In order to address this issue, experts suggest the proper implementation of government-initiated measures, along with directives on imports, and the formulation of short- and medium-term strategies. Without these actions, it is anticipated that handling the situation will become increasingly challenging.

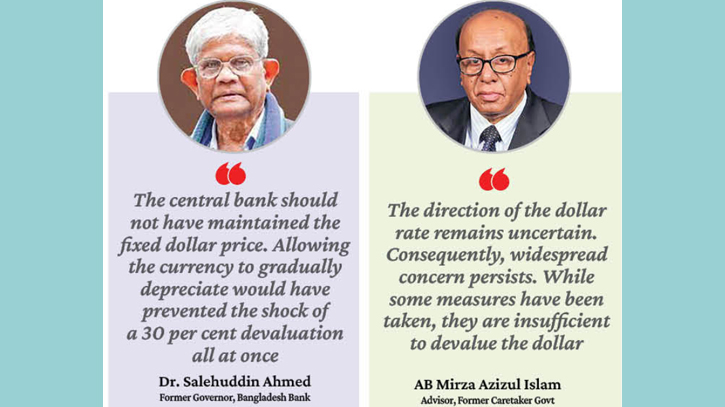

Dr. Salehuddin Ahmed, former governor of Bangladesh Bank, sheds light on the plight of the dollar in the market, saying to The Daily Messenger, “The central bank should not have maintained the fixed dollar price. Allowing the currency to gradually depreciate would have prevented the shock of a 30 per cent devaluation all at once. The lack of timely decisions is evident. Holding back the value of the dollar was a misstep by the bank.”

Meanwhile, the import Letter of Credit (LC) for consumer goods, industrial intermediate raw materials, and industrial machinery has decreased due to the dollar crisis. This trend has persisted into the first two months of the new financial year, resulting in a negative impact on the industrial sector. In addition to declining production, investment and employment rates have also experienced a decline.

Aside from the impact on the industrial sector, the dollar crisis has also severely affected the country's overall economy. The extent of the damage is becoming increasingly evident. Prices have been on the rise since April of last year due to the dollar crisis. In 2022, the cost of one dollar was Tk 84. However, it has now surged to over Tk 109.50. Over this period, the price has increased by Tk 25.50 or 30 per cent.

In other words, the value of money has declined by 30 per cent in just one and a half years. This surge in the dollar's value has had a negative impact on all segments of society. Moreover, the situation has exacerbated due to the rising prices of international goods.

Observers have highlighted the necessity of boosting foreign exchange income to address the dollar crisis. Despite the government's efforts to manage the crisis by cutting expenditures, the need for higher foreign exchange earnings remains. The government is attempting to control imports to reduce foreign exchange expenses. However, this prolonged period of import restrictions has jeopardized industries reliant on imports. This raises concerns about escalating default rates and diminishing employment within these sectors.

According to a central bank report, growth in the two major sources of foreign exchange earnings – export earnings and remittances – has been marginal, while expenses continue to grow. Consequently, there is a shortage of foreign exchange, which has led to an increase in the dollar's price. Concurrently, foreign exchange reserves are also under strain.

Though recent times have seen a reduction in imports, the outstanding import debt and foreign debt repayments are insufficient to meet the required dollar reserves each month. Presently, the average monthly income is 700 crore dollars, while immediate import debt amounts to 650 crore dollars. Additionally, around 100 crore dollars are allocated for debt repayments, resulting in a monthly deficit of 50 crore dollars. Furthermore, additional expenses are incurred through various services, royalties, and overseas profit repatriation. This perpetuates the monthly dollar shortage.

AB Mirza Azizul Islam, advisor to the former caretaker government, told The Daily Messenger, “The direction of the dollar rate remains uncertain. Consequently, widespread concern persists. While some measures have been taken, they are insufficient to devalue the dollar.”

He further said that the primary reason behind the crisis is the depletion of reserves. The dollar market experiences volatility, necessitating efforts to bolster exports and increase reserves. Successfully augmenting reserves could pave the way to overcoming the prevailing state of the dollar market.

TDM/SD