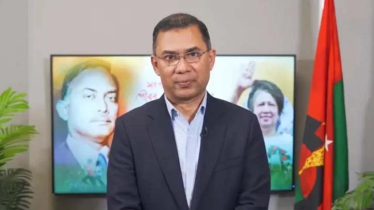

Photo : Messenger

In the upscale areas of the capital—Gulshan, Baridhara, and Banani—there exists a significant prevalence of tax evasion concerning the transactions involving land and apartments. During the registration process, the declared prices often stand at 50 to 60 percent below the actual market value, a tactic employed to circumvent taxation. The culprits of this evasion span across various sectors including corporate entities, professionals, traders, doctors, and lawyers. However, authorities refrain from disclosing specific names at this stage to facilitate ongoing investigations.

Professor Dr Kudrat e Khuda Babu expressed deep concern over the alarming trend of tax evasion among the privileged class in society. He emphasised that while tax compliance among the general populace is already low, the participation of the elite in such deceptive practices sets a concerning precedent.

Babu underscored the importance of the National Board of Revenue taking a vocal stance on this matter.

Minhaj Uddin, Additional Director General of the Customs Intelligence Department, mentioned that disclosing names is not feasible at the moment due to ongoing investigations. He urged those involved to rectify their actions promptly to avoid legal consequences in the future.

Complaints have surfaced regarding the under-declaration of prices in transfer documents for multi-storied buildings in these areas, resulting in the sale of properties at significantly reduced values. It has been observed that the declared prices in these transactions are notably lower than the actual cost per square foot of the building or flats.

A recent investigation conducted by the National Board of Revenue's Central Intelligence Cell revealed instances of substantial revenue losses due to such practices. Specifically, a commercial multi-storied building situated on Banani-Tejgaon Link Road and a residential multi-storied building located on Gulshan Avenue Road were scrutinised, uncovering significant discrepancies in declared values during the sale or transfer of land, flats, or spaces.

In this case, the Central Intelligence Cell reported that buyers have been consistently undervaluing their investments in purchased flats or floor spaces in their income tax documents, declaring nominal values significantly lower than the actual market price. Moreover, it has been observed that some buyers, despite making installment payments over a period of 3-4 years, have failed to reflect these payments as advances in their income tax documents.

Such practices not only contribute to revenue losses for the government but also raise concerns about the transparency and accuracy of financial disclosures. Failure to report accurate transaction values and installment payments can potentially facilitate tax evasion and financial irregularities.

In this scenario, it is evident that the country is suffering revenue losses from both ends of the transaction. On one hand, individuals are evading significant amounts of income tax by concealing the source of the substantial funds they utilise for these investments.

On the other hand, by registering properties at undervalued prices, individuals are also paying lower amounts of income tax and other associated revenues.

This not only results in immediate revenue losses but also distorts property valuation metrics, potentially impacting future tax assessments and overall fiscal planning.

The investigation conducted by the National Board of Revenue's Central Intelligence Cell (NBR's CIC) has uncovered significant instances of tax evasion by buyers of residential space in multi-storied duplex, simplex, and penthouse buildings located along the south-facing lake in North Gulshan.

One notable case involves a renowned ophthalmologist associated with Dhaka's prominent eye hospital. It is suspected that the ophthalmologist has utilised the purchase of a 4375 square feet flat, valued at 13 crore taka, registered at a mere 4.5 crore taka, to legalise assets amounting to Tk 8.5 crores.

Additionally, it has come to light that a member of the national cricket team has purchased a flat in one of these residential buildings worth 12.40 crore taka, yet has failed to declare this investment in his income tax documents.

As the investigation progresses, more revelations have surfaced regarding tax evasion involving prominent individuals from various sectors.

Firstly, the managing director of a renowned securities company has been found to have evaded taxes on a significant amount of wealth. The exact sum has not been disclosed, but it is indicative of substantial financial irregularities within the securities sector.

Secondly, a prominent Supreme Court barrister has been implicated in the evasion of taxes related to the purchase of a flat worth approximately Tk 13 crores. Despite the substantial investment, the barrister has failed to include this asset in his income tax documents.

Furthermore, a well-known businessman has purchased space in a multi-storied building located at 50 Gulshan Road for approximately Tk 28 crore.

Shockingly, not a single Taka from this transaction has been reported in the individual's income tax return, indicating blatant tax evasion by a prominent figure in the business community.

The inquiry has revealed concerning findings related to a securities company's investment in a commercial building on Banani-Tejgaon Link Road.

Upon reviewing the audit report of the securities company, it was discovered that although the company had made an investment of Tk 73 crore in the form of search space, only Tk 55 lakh was disclosed in the audit report.

The investigation has uncovered further instances of tax evasion involving undisclosed transactions by various companies.

One company, despite making a payment of Tk 13 crores, has failed to disclose this expenditure in its audit report, indicating a blatant attempt to evade tax obligations.

Similarly, a reputed bicycle manufacturing and marketing company has purchased commercial space amounting to Tk 35.25 crore, yet this significant investment has not been reflected in its income tax documents.

Preventing revenue evasion necessitates the accurate declaration of assets purchased or invested at their fair value. This approach serves dual purposes:

undisclosed income is revealed in income tax documents, ensuring proper taxation, while taxes can be accurately collected during asset registration.

Messenger/Disha