Photo : Messenger

In a recent survey of retail Islamic banking customers from diverse countries, a resounding enthusiasm for sustainability emerged, reflecting a strong belief that Islamic finance aligns seamlessly with the Sustainable Development Goals (SDGs). However, as Environmental, Social, and Governance (ESG) risks loom and concerns about greenwashing intensify, the imperative for Islamic banks to maintain customer confidence has never been more pressing. This calls for a strategic shift towards financing the climate transition, supporting sustainable economic development, and actively addressing ESG risks.

The survey, conducted by the Global Ethical Finance Initiative (GEFI), unveiled a shared commitment to sustainability among retail Islamic banking consumers, even when faced with potentially higher costs. The identification of customers with the ethical promises of Islamic banks has created a consumer base willing to pay for financial services aligned with the SDGs.

Interestingly, disparities emerged between customers in the 'Global North' (e.g., UK and Australia) and the 'Global South' (e.g., Nigeria, Pakistan, and Malaysia). While participants from the Global North displayed a balanced emphasis on issues such as environment and climate change, equality and justice, and sustainable economic development, respondents from the Global South placed a higher importance on sustainable economic development. This variation suggests nuanced priorities driven by distinct economic challenges.

Notably, consumers in the Global South demonstrated a higher familiarity with impact investing and a greater willingness to pay a premium for SDG-aligned products compared to their counterparts in the Global North. This indicates a potential avenue for Islamic banks to strengthen their resilience against future ESG risks by demonstrating tangible impacts.

The findings underline the need for Islamic banks to bridge the gap between retail customers' sustainability priorities and corporates' capabilities. To avoid greenwashing risks, Islamic banks must not only meet but exceed customer expectations in delivering sustainable outcomes.

One key takeaway is the continued willingness of customers, especially in the Global South, to pay a premium for Islamic finance. However, this comes with an elevated expectation of the real-world impact compared to conventional finance. As Islamic finance assets grow despite currency depreciation, there is an opportunity for Islamic banks to position themselves as responsible financial institutions.

Yet, there is a potential vulnerability if customers view Islamic banks merely as an alternative to express ethical priorities rather than recognising them as leaders in sustainability. With the global expansion of ESG practices, Islamic banks face the challenge of differentiating their contributions to sustainability beyond Shariah compliance.

The risk lies in the possibility that sustainability appeals more to retail customers than to corporate entities seeking financing. Islamic banks must navigate this challenge by transparently showcasing the sustainability of their products while simultaneously addressing commercial pressures to attract customers with competitive deposit rates.

Greenwashing concerns, pervasive in the banking industry, pose a unique threat to Islamic banks due to their explicit ethical orientation. Leveraging the pricing advantage for SDG-aligned products could help Islamic banks fortify their offerings against greenwashing suspicions and solidify their commitment to ethical finance.

The survey suggests that if Islamic banks can retain their retail customer base while expanding offerings for sustainability novices, they may gain a dual advantage. By aggressively addressing ESG risks, Islamic banks could outpace conventional competitors and foster greater resilience to climate-related challenges.

For instance, focusing on adaptation or transition finance related to climate change could position Islamic banks to attract a customer base less susceptible to climate risks. This strategy would not only reinforce the competitive advantage of Islamic banks but also showcase a tangible positive outcome from a customer base united by a shared belief in sustainable finance through Islamic principles.

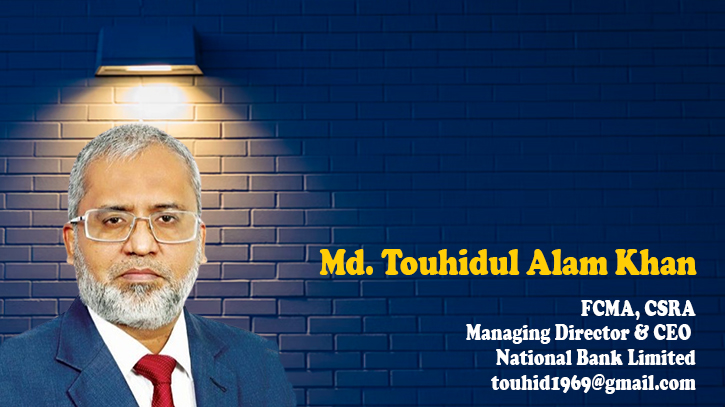

The author is the Managing Director & CEO of National Bank Limited. He is a fellow member of the Institute of Cost & Management Accountants of Bangladesh (ICMAB) and the first Certified Sustainability Reporting Assurer (CSRA) in Bangladesh. He is also a post-graduate diploma from the Institute of Islamic Banking & Insurance (IIBI), United Kingdom.

Messenger/Sajib