Photo : Messenger

Ethical considerations are becoming a significant and mainstream component of financial markets as stakeholders increasingly prioritize investments with positive social or environmental impacts, such as sustainable agriculture, renewable energy, and climate action.

Emerging trends in ethical investing Increased Awareness and Interest: There has been a growing awareness and interest in ethical investing in recent years. More people are looking to align their investments with personal values, driving demand for investment opportunities that reflect their ethical principles.

Growth of sustainable and responsible investment (SRI) funds: The number of SRI funds has grown significantly, focusing on ethical and sustainable investing. This trend is expected to continue as investors seek options that align with their ethical standards. Financial markets are adapting by expanding regulatory oversight and facilitating this growth.

Several regulatory milestones highlight this development: 2014: The Sustainable and Responsible Investment (SRI) Sukuk Framework was launched by the Securities Commission Malaysia to support sustainable and responsible investment initiatives.

2017: Indonesia’s Financial Services Authority introduced regulations for the issuance of green bonds, promoting environmentally friendly capital market products.

2021: Pakistan’s Securities and Exchange Commission issued national guidelines for green bonds and Sukuk. Oman drafted regulations for SRI, Waqf, sustainability, green, and blue bonds, and Sukuk. By December 2021, over USD 1 trillion in sustainable bonds were outstanding globally, including USD 118.8 billion in sustainability-linked bonds. 2022: Kuwait amended its Capital Markets Law to regulate green, sustainability, and social- impact bonds and Sukuk. Qatar issued the QFC Sustainable Sukuk and Bonds Framework, and the UAE introduced the Sustainable Finance Framework 2021-2031. Bangladesh Bank launched its policy on green bond financing, and Malaysia’s SC introduced the SRI-linked Sukuk Framework.

Increased focus on ESG criteria: Ethical investors increasingly use Environmental, Social, and Governance (ESG) criteria to guide investment decisions. ESG criteria evaluate a company’s sustainability and ethical performance. This increased focus reflects a broader investor desire to support companies with robust ESG practices.

Convergence of Shariah and sustainable investing: Islamic finance and sustainable/ESG investing share many goals, such as promoting stewardship, social responsibility, and ethical conduct. Islamic finance, with its emphasis on fairness and social justice, offers a strategic approach to sustainability and ESG. Shariah rulings aim to prevent wealth concentration, supporting broader societal prosperity.

Mainstream integration of ethical investing: Ethical investing is no longer a niche market. It is increasingly integrated into mainstream financial products and services. This trend is expected to grow as investors seek ethical investment opportunities and financial institutions expand their offerings in this space.

Ethical investing is transforming the financial markets, driven by growing investor demand for sustainable and responsible investment options. This movement aligns financial practices with ethical values and fosters a more sustainable and equitable economic system.

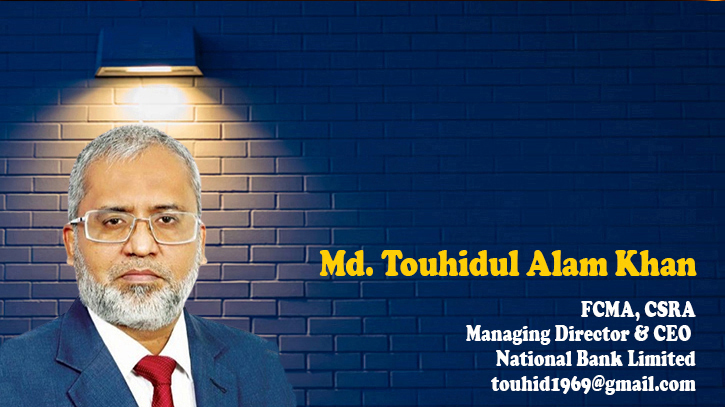

The author is the Managing Director & CEO of National Bank Limited. He is a fellow member of the Institute of Cost & Management Accountants of Bangladesh (ICMAB) and the first Certified Sustainability Reporting Assurer (CSRA) in Bangladesh. He is also a post- graduate diploma from the Institute of Islamic Banking & Insurance (IIBI), United Kingdom.

Messenger/Fameema