Photo : Collected

Recent studies indicate that the Islamic banking and finance sector is rapidly gaining ground in the global financial markets, driven by industry development efforts and intensified competition with conventional banking. In 2021, the industry's total assets were estimated at a substantial $3.6 trillion, boasting a cumulative annual growth rate of 7.88% and a network of 1,553 fully-fledged Islamic financial institutions and windows. Anticipations are high, with expectations that the Islamic finance industry will swell to assets worth $5 trillion by the year 2025.

In light of recent developments in the industry, the Islamic economy has ascended to a prominent position in the economic strategies of several nations, particularly in their efforts to recover from the economic repercussions of the COVID-19 pandemic. This upward trajectory was set in motion even before the pandemic struck, with several nations enacting national Islamic economic policies, most notably Indonesia's mandatory Halal law.

Countries like Saudi Arabia, the UAE, Malaysia, Nigeria, and now Bangladesh have expanded their support behind the expansion of the Islamic economy, particularly in sectors like Halal food, Islamic finance, and fintech. In addition to that, Pakistan, Qatar, and Kuwait have unveiled plans to introduce centralized regulations in the Islamic finance sector to enhance governance.

Islamic finance serves as the linchpin for the broader ecosystem. Malaysia has consistently secured the top spot in the Global Islamic Economy Indicator for nine consecutive years. It is followed closely by Saudi Arabia, Bahrain, Kuwait, the UAE, Indonesia, as well as Iran, Oman, Qatar, and Jordan. The Islamic finance sector in Malaysia has seen remarkable growth, with a 9% surge in Islamic finance assets and a 20% increase in the value of Islamic funds. Saudi Arabia has also exhibited substantial strength across various sectors of Islamic finance, while new players like Pakistan, the UK, Singapore, Nigeria, Sri Lanka, and Kazakhstan have entered the arena.

Bangladesh is also a robust partner in the global Islamic finance arena and it is fast becoming a noteworthy player. The country's Islamic finance sector is gaining ground, with a growing Sukuk market and increasing participation in Islamic banking. Bangladesh is demonstrating its commitment to Islamic finance, and its rapid growth in this sector is a promising sign of its aspirations in the field.

Malaysia, Saudi Arabia, and Indonesia remain the dominant hubs for Sukuk issuances. Environmentally friendly and sustainable Sukuk are gaining global popularity due to support from the Islamic Development Bank (IsDB) and the commitment of OIC member countries like Indonesia.

The IsDB has played a significant role in the Sukuk market, issuing a $2.5 billion sustainability Sukuk facility, and Malaysia issued the world's first sovereign dollar-denominated Islamic finance sustainability-related commercial notes. The World Bank has acknowledged the role of Islamic finance in supporting the UN Sustainable Development Goals.

In 2023, the global Sukuk market and corporate Sukuk issuances are being continued their growth. Islamic financing based on the Sukuk instrument remains instrumental in supporting real economy sectors such as construction, real estate, electricity, and addressing government deficits in various countries. The IsDB has introduced a Sukuk facility linked to the Secured Financed Overnight Rate (SOFR), a significant development as LIBOR phases out, with SOFR emerging as the new global benchmark rate. Moreover, Sukuk issuances are increasingly directed toward sustainable or "green" investments in addition to traditional Sukuk sectors.

The rising traction of green and sustainability Sukuk indicates growing investor interest in striking a balance between social impact and financial returns. Therefore, establishing a robust governance structure to ensure Islamic financial institutions adhere to Shariah rules issued by legislative bodies is imperative. In summary, a commitment to good governance in the Sukuk industry will propel the Islamic finance and Sukuk sector forward, operating in line with best practices and ensuring its sustained growth, with no deviation from the righteous path.

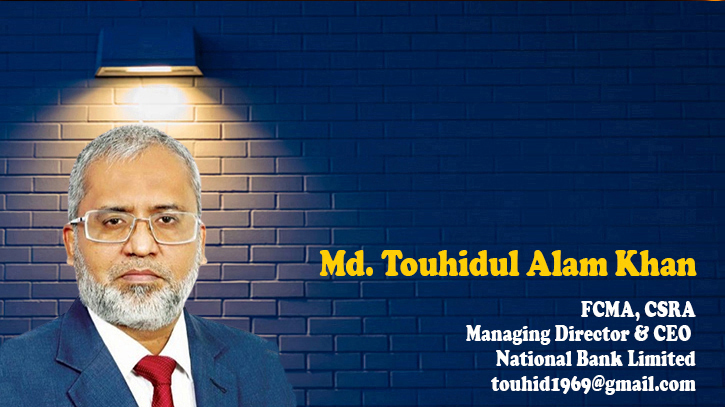

The author is the Managing Director & CEO of National Bank Limited. He is a fellow member of the Institute of Cost & Management Accountants of Bangladesh (ICMAB) and the first Certified Sustainability Reporting Assurer (CSRA) in Bangladesh. He is also a post-graduate diploma from the Institute of Islamic Banking & Insurance (IIBI), United Kingdom.

Messenger/Fameema