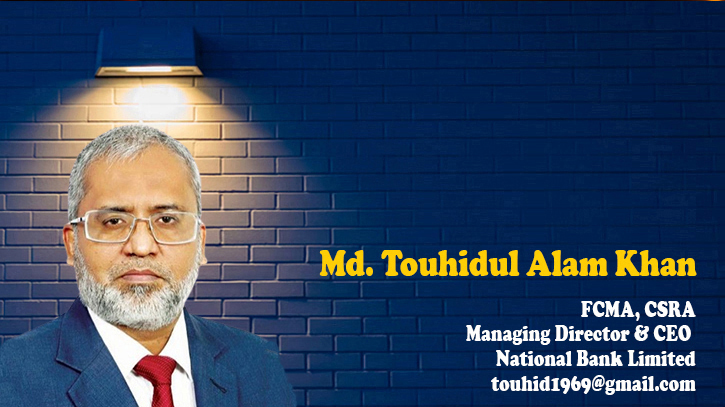

Photo : Messenger

Islamic banking has become increasingly prominent, demonstrating robust growth trends and resilience in the face of changing financial landscapes. This evolving narrative is about financial instruments and returns and reflects a commitment to ethical and sustainable finance. In this exploration, we delve into the key trends propelling Islamic finance into the forefront of the global financial sector.

Innovation in Islamic Finance: A convergence with ESG standards

Islamic finance adapts to contemporary demands by aligning with Environmental, Social, and Governance (ESG) standards. A noteworthy example is the emergence of green Sukuk, Shariah-compliant bonds designed to fund environmentally friendly projects. This innovation reflects a growing interest among investors in supporting sustainable initiatives while adhering to Islamic principles. Sustainability-linked Islamic finance instruments and Shariah-compliant ESG funds further exemplify the industry's commitment to ethical investing.

Global expansion amid economic challenges

Islamic finance assets are poised for significant expansion globally, particularly in 2023–24. The Gulf Cooperation Council (GCC) countries, led by Saudi Arabia and Kuwait, are driving this growth, contributing to a remarkable 92% increase in Islamic banking assets. Saudi Arabia's Vision 2030 and Kuwait's transformative acquisition of Ahli United Bank have been pivotal in shaping the financial landscape in the region.

Southeast Asia's growth momentum

Despite economic challenges in Southeast Asia, the Islamic banking sector is projected to experience an 8% growth. The region, particularly countries like Malaysia and Indonesia, displays a strong appetite for Shariah-compliant products, setting the stage for continued expansion.

Fintech, financial inclusion, and digitalization

The Islamic finance sector witnessed a transformative shift in 2022, driven by financial inclusion and rapid digitalization, propelled by the rise of Islamic fintech. This trend is expected to persist, offering diverse products and platforms globally.

Resilience in the face of global dynamics

In 2022, Islamic banking institutions showcased resilience amid global economic challenges, reporting consistent growth, robust profitability, and increased liquidity. The sector's response to global challenges is evident in the growing popularity of sustainable Sukuk and green financial products, highlighting a commitment to environmental and ethical financing.

Meeting the Challenges: Broadening Appeal and Embracing Digital Momentum

While Islamic finance experiences growth, there's an opportunity to make it more expansive. Embracing digital avenues is crucial for its continued growth, aligning with the global shift toward digitalization. Additionally, understanding and appealing to the financial perspectives of younger generations, particularly Gen Z and millennials, who prioritize sustainability, can be a linchpin for sustained dynamism in Islamic finance.

Future outlook: Standardization and digitalization

Looking ahead, the future of Islamic finance is marked by a move toward greater standardization, coupled with ongoing digitalization, especially in Sukuk issuance. This convergence of traditional principles with modern technology holds the potential to structurally enhance the industry's growth prospects, possibly ushering Islamic banking into a golden era.

In conclusion, the narrative of Islamic banking is evolving beyond financial instruments—it's a story of ethical and sustainable finance, adapting, innovating, and leading in a volatile world. As Islamic finance continues to grow and diversify, its impact on the global financial landscape becomes increasingly significant.

Messenger/Fameema