In finance, the concept of interest has long been a subject of debate and scrutiny, particularly as societies strive for ethical and equitable economic systems. While Islamic banking adheres to Shari'ah principles and seeks to mitigate exploitation, it still maintains a connection to benchmark rates tied to interest mechanisms. However, the idea of a completely interest-free financial system is not far-fetched; it invites a reconsideration of traditional banking paradigms. By delving into the concept of Qard Hassan, which emphasizes benevolent lending, and innovatively structuring loans with Time Multiple Counter Value Loans (TMCVLs), a pathway to revolutionizing the financial landscape emerges.

The foundation of a truly interest-free financial system lies in the principle of Qard Hassan, which translates to a benevolent loan—one that does not accrue interest or additional fees. This concept is rooted in ancient mutual aid and community support practices, prioritizing social welfare over profit maximization. Instead of allowing interest to dictate the terms of financial transactions, a system inspired by Qard Hassan promotes ethical lending, where assistance is provided in times of need without the burden of repayment with interest.

To bring this concept to fruition, an innovative approach such as Time Multiple Counter Value Loans (TMCVLs) may be implemented. This model diverges significantly from traditional lending and saving practices by allowing individuals to save or deposit funds with a financial institution on an entirely interest-free basis. In a TMCVL framework, the amount saved serves as the basis for obtaining interest-free loans that significantly exceed the deposited value for specific durations.

For instance, if an individual deposits $100 with a financial institution for 30 days, they can become eligible to receive an interest-free loan of $3,000 for one day, $1,500 for two days, or $1,000 for three days. The essence lies in the fact that both savings and loans under TMCVLs function on an interest-free basis. This represents a transformative departure from the conventional banking narrative, wherein interest on loans is typically seen as an inevitable requirement.

A crucial element of the TMCVL model is the alignment of deposited amounts, loan values, and timeframes without imposing interest charges. This framework fosters equitable exchanges and encourages participants to engage in mutually advantageous transactions. The differential value between savings and loans, along with varying time durations, establishes a sustainable economic model that ensures that both savers and borrowers benefit. Importantly, larger participant engagement is central to the success of this model, allowing it to gain traction in the commercial sphere.

The implementation of TMCVLs offers a paradigm shift in the financial sector by fostering inclusivity and ethical practices, enhancing the overall integrity of financial interactions. This system, while innovative, resonates deeply with existing practices found in cooperative banking models and community financing, which emphasize solidarity and mutual support as foundational elements. In this light, TMCVLs are positioned not merely as an alternative but as a necessary evolution in response to growing disillusionment with traditional interest-based systems.

The current global landscape has seen a burgeoning interest in ethical and sustainable financial practices. With societal and consumer pressures mounting against predatory lending and economic inequality, the feasibility of developing a completely interest-free financial system is increasingly recognized as vital. Progressive institutions and policymakers are exploring innovative solutions like TMCVLs to reshape the financial landscape and respond effectively to diverse clientele needs, especially in underserved communities.

As the global financial ecosystem continues to evolve and adapt to new challenges exacerbated by economic crises, the prospect of an entirely interest-free financial system presents a compelling vision for a fairer, more inclusive economy. By embracing principles of fairness, transparency, and cooperation, implementing models such as TMCVLs could lead to a transformation that prioritizes the welfare of all participants in the financial system.

In conclusion, exploring Time Multiple Counter Value Loans as a vehicle for establishing an interest-free financial system not only holds promise for reshaping the conventional notions of banking and finance but also aligns with the growing demands for ethical financial practices. By leveraging the principle of Qard Hassan and advocating for innovative structures like TMCVLs, the realization of a financial system devoid of interest charges appears increasingly plausible. This vision points towards a more equitable and sustainable financial future, inviting collaboration and participation from a wide spectrum of society.

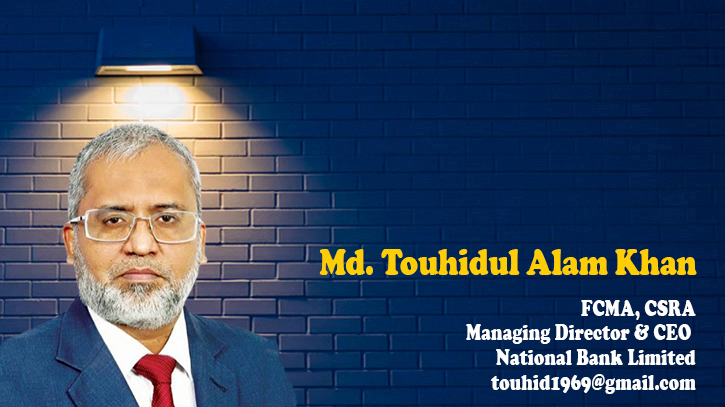

The author is the Managing Director & CEO of National Bank Limited. He is a fellow member of the Institute of Cost & Management Accountants of Bangladesh (ICMAB) and the first Certified Sustainability Reporting Assurer (CSRA) in Bangladesh. He is also a post-graduate diploma from the Institute of Islamic Banking & Insurance (IIBI), United Kingdom.

Messenger/EHM